Review | Capital In The Twenty-First Century by Thomas Piketty Books

Books, New in Ceasefire - Posted on Thursday, May 29, 2014 18:51 - 1 Comment

By Rohail Ahmad

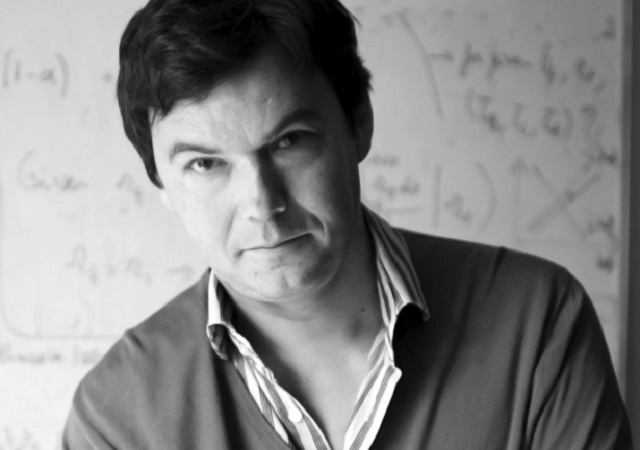

Capital in the Twenty-First Century by Thomas Piketty is the book of the moment. Joining a long line of admirers, Paul Krugman has described it as “the most important economics book of the year – and maybe of the decade.” Piketty (1971-), a French economist who specialises in the study of economic inequality, is the director of studies at EHESS in Paris and the Associate Chair at the Paris School of Economics.

As the title of the book suggests – and subversive protestations to the contrary notwithstanding – Piketty’s grand ambition seems to be to bring Marx up to date. However, whereas Marx’s aim was to destroy capitalism, Piketty’s goal, quite crucially, is merely to regulate it. In many ways, thus, the book echoes Joseph Stiglitz’s The Price of Inequality and Paul Krugman’s End This Depression Now!, but while they focused on data from the past few decades, Piketty has gone back three centuries. This alone is no mean achievement.

In terms of accessibility, though the book is handsomely written and translated, with a flowing prose in which Piketty liberally marshalls literary references, from Honore de Balzac to Jane Austen, to illustrate his arguments, the text does become rather repetitive and congested with too many asides and caveats. This minor quibble aside, however, there is no reason why the general reader cannot appreciate the intellectual delights on offer. Its six hundred page-count ought not to put him/her off either, and nor, as the author himself says, should the occasional equation: “I ask readers not well versed in mathematics to be patient and not immediately close the book: these are elementary equations, which can be explained in a simple, intuitive way and can be understood without any specialised technical knowledge.” Indeed, Piketty later points out that “social scientists in other disciplines should not leave the study of economic facts to economists and must not flee in horror the minute a number rears its head,” insisting that “all social scientists, all journalists and commentators, all activists in the unions and in politics of whatever stripe, and especially all citizens [italics added] should take a serious interest in money, its measurement, the facts surrounding it, and its history.”

Piketty identifies two laws of capitalism, placing them at the heart of the central contradiction of capital. Put simply, if the return on capital is greater than the general growth of the economy, then this will inevitably lead, over time, to those with capital increasing their wealth in relative terms; until they eventually own all capital and thus put an end to capitalism itself.

Of course, that this is hardly news; rather, what gives the book’s intellectual thrust its potent freshness is not so much its arguments or conclusions, but the fact that Piketty has analysed data going back to the year 1700 and “proved” that inequality is reaching extreme, dangerous and unjust levels, particularly when it comes to the top 1% and, even more so, the top 0.1% of the global population. Furthermore, in writing his book, Piketty claims he is seeking to disprove “both conservative and liberal economists [who] were keen to show that growth benefited everyone.” In this regard, one of his most compelling conclusions is that “The idea that unrestricted competition will put an end to inheritance and move toward a more meritocratic world is a dangerous illusion.”

Piketty’s main solution to the problem of inequality is a progressive global tax on capital. He makes a persuasive case for this, whilst fully acknowledging that it is perhaps a “utopian ideal” for the moment and will take time to implement. He insists on the importance of greater transparency and monitoring of financial data; indeed, his proposed tax cannot work without it. Piketty also flags up the discrepancy between the reported data and what can be inferred from other sources. In this context, he quotes a fellow researcher, Gabriel Zucman, who says “the most plausible reason for the discrepancy is that large amounts of unreported financial assets are held in tax havens. By his cautious estimate, these amount to nearly 10 percent of global GDP”. With regards to current public debt, Piketty believes “an exceptional tax on private capital is the most just and efficient solution […] The worst solution in terms of both justice and efficiency is a prolonged dose of austerity – yet that is the course Europe is currently following.” Indeed, as many have pointed out, the money stashed away in tax havens could easily pay off this debt.

So far, so good. The main problem with the book is that it is, like the aforementioned works of Stiglitz and Krugman, focused almost exclusively on Europe and North America – surely a glaring omission in this globalised world? Only one chapter out of sixteen, and the odd short section here and there in other chapters, is devoted to poor countries. In fact, even in those he is mostly referring to emerging economies such as China and India; poor African countries and other poor Asian countries such as Pakistan barely get a passing mention. Piketty says that this is because of a lack of data on poor countries which, one supposes, is fair enough. But he goes on to say that: “In the long run, unequal wealth within nations is surely more worrisome than unequal wealth between nations.” [italics added] Surely not, in the age of globalisation, of mass migration and modern slavery? In fact, he later seems to contradict himself: “inequality of wealth in the twenty-first century will have to be gauged more and more at the global level” he asserts, later adding that “the question of what kind of fiscal and social state will emerge in the developing world is of the utmost importance for the future of the planet.”

Moreover, even if implemented, the global tax on wealth would surely be very much a rich-country affair; from which the poor countries would hardly benefit. What they would benefit from, of course, is a global minimum wage, as advocated by Muhammad Yunus, a Nobel prize-winning economist. Piketty does talk about minimum wages, and is not against them; arguing for instance, that “this theoretical model, based on imperfect competition, is the clearest justification for the existence of a minimum wage: the goal is to make sure that no employer can exploit his competitive advantage beyond a certain limit.” Nevertheless, he does not pursue this as a companion solution to the problem of inequality, especially global inequality. In fact, he states explicitly that “This is not the place to write a detailed history of minimum wages and wage schedules around the world or to discuss their impact on wage inequality.” Yet surely, this is exactly the place to do just that?

Piketty mentions that in previous centuries extreme inequality of wealth was almost considered as an acceptable condition of civilisation: an elite lived a life of culture on behalf of humanity, supported by a mass of servants. In significant measure, this is still the case today, except that the division is now global: people in rich countries live lives of luxury – despite the financial crash – at the expense of poor countries and their cheap labour. And yet, this question of cheap labour in poor countries is one that Piketty does not address at all, surely the weakest point of an otherwise solid argument. He does discuss traditional slavery and gives a hint of awareness of cheap labour when he says “[slave] societies that at first sight [italics added] have definitively ceased to exist”. But he does not pursue this comment any further. (In response to a query from the author, Professor Piketty replied that “Progressive wealth taxation and wage policy should definitely be viewed as complementary (not substitutes)”. Piketty also apologised “if the book underplays the importance of between country inequality, this is not what I meant.”)

Krugman says that Piketty has provided what amounts to a “unified field theory of inequality”. But surely, a theory that does not take into account half the world – and does not discuss wages – cannot make this claim? That caveat aside, however, Piketty deserves huge credit for an epic and groundbreaking study of national inequalities, which deserves to be read by everyone.

Krugman says that Piketty has provided what amounts to a “unified field theory of inequality”. But surely, a theory that does not take into account half the world – and does not discuss wages – cannot make this claim? That caveat aside, however, Piketty deserves huge credit for an epic and groundbreaking study of national inequalities, which deserves to be read by everyone.

Capital in the Twenty-First Century

Thomas Piketty

Translated by Arthur Goldhammer

HARDCOVER

ISBN 9780674430006

Publication: April 2014

696 pages

This book is a must read for economic graduates and those with a general interest in the distribution of wealth and inequality. Prof. Thomas Picketty, who teaches at Paris School of Economics dissects the economic history of developed countries to examine the nature of capital and its structure in the coming century where inheritance may have to play a bigger role than merit. A book with lasting consequences for the discipline it is a part of! Flipkart delivery was prompt and I got an advantageous price too. Go for it!